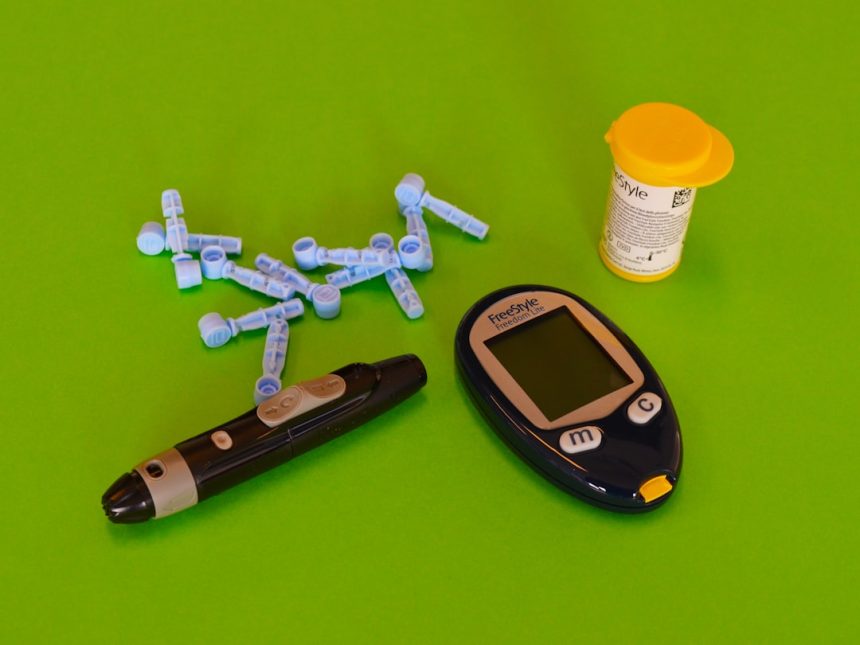

Mounjaro, a medication primarily used to improve blood sugar control in adults with type 2 diabetes, has gained popularity not only for its health benefits but also for its potential role in weight management. The good news is that if you’re interested in using Mounjaro but are concerned about the cost, you may be eligible for rebates and savings programs that significantly lower your expenses. Understanding how to qualify for these savings can make a real difference to your healthcare budget.

What Is Mounjaro?

Mounjaro (tirzepatide) is a once-weekly injectable prescription medicine that works by mimicking two hormonal signals that help regulate blood sugar levels and reduce appetite. Approved by the FDA, it’s designed to improve glycemic control in adults with type 2 diabetes, but studies and off-label uses have highlighted additional benefits such as weight loss.

High Demand and High Cost

Due to its increasing popularity—especially among those looking for alternatives to medicines like Ozempic or Wegovy—the demand for Mounjaro has surged. However, one of the major roadblocks for many patients is the high retail price, sometimes exceeding $1,000 per month without insurance. This is where rebates and online savings programs become incredibly valuable.

How to Qualify for Mounjaro Rebates

The manufacturer, Eli Lilly, has developed a co-pay savings program to help eligible patients afford their medication. Here’s how you can qualify:

- Prescription Requirement: You must have a valid prescription from a healthcare provider to use Mounjaro.

- Insurance Status: Most Lilly savings card programs are designed for those who have private or commercial insurance. Unfortunately, Medicare, Medicaid, or other government-insured patients usually do not qualify.

- Online Registration: Patients can register for the Mounjaro Savings Card through the official Mounjaro website.

- Eligibility Verification: During registration, you’ll be asked for insurance details to verify whether you meet the program’s criteria.

Once enrolled, eligible users could pay as little as $25 per month for their prescription, depending on their insurance plan’s coverage.

[ai-img]mounjaro injection, diabetes medication, prescription discount[/ai-img]

Using the Online Mounjaro Savings Card

After you complete your registration and are approved, you’ll receive a digital savings card. Here’s how to use it effectively:

- Print or Save the Card: You’ll get access to your card via email or on the website directly. Save it or print it before visiting your pharmacy.

- Pharmacy Presentation: Present the card to your pharmacist just like you would an insurance or discount card.

- Refills and Renewals: The savings card can usually be reused each month for up to 12 months but be sure to recheck terms regularly for updates.

Always confirm with your pharmacy that they accept the card, and make sure your prescription is filled in accordance with the terms laid out in the savings program.

Additional Ways to Save Online

Besides using the manufacturer’s coupon program, you may also want to look into the following online savings strategies:

- Discount Pharmacy Websites: Websites such as GoodRx or SingleCare may offer discounts on Mounjaro if you’re paying out of pocket.

- Pharmacy Price Comparisons: Prices can vary dramatically between pharmacies. Use price comparison tools to find the best deal near you.

- Manufacturer Promotions: Sign up for Eli Lilly’s email alerts or follow their official page to stay informed of new promotional programs and offers.

Common Pitfalls to Avoid

While these savings opportunities are fantastic, there are some caveats to beware of:

- Government Insured Patients: If you’re covered by Medicare, Medicaid, or other federal programs, you may be excluded from many manufacturer coupon programs under U.S. law.

- Out-of-Pocket Maximums: Commercial insurance plans may have rules that affect how manufacturer-assistance dollars are applied to your deductible or out-of-pocket max.

- Expiration Dates: Savings cards and coupons often come with expiry dates, so take note and renew them if possible.

[ai-img]prescription savings card, online pharmacy, medical discount[/ai-img]

Final Thoughts

Affording a cutting-edge medication like Mounjaro is possible even for budget-conscious patients, thanks to rebates and savings programs offered by its manufacturer and third-party platforms. By understanding the qualifications, taking advantage of digital tools, and staying ahead on renewal deadlines, you can dramatically reduce your out-of-pocket costs. Always consult with your healthcare provider or pharmacist for personalized advice on saving with Mounjaro based on your own insurance and medical needs.